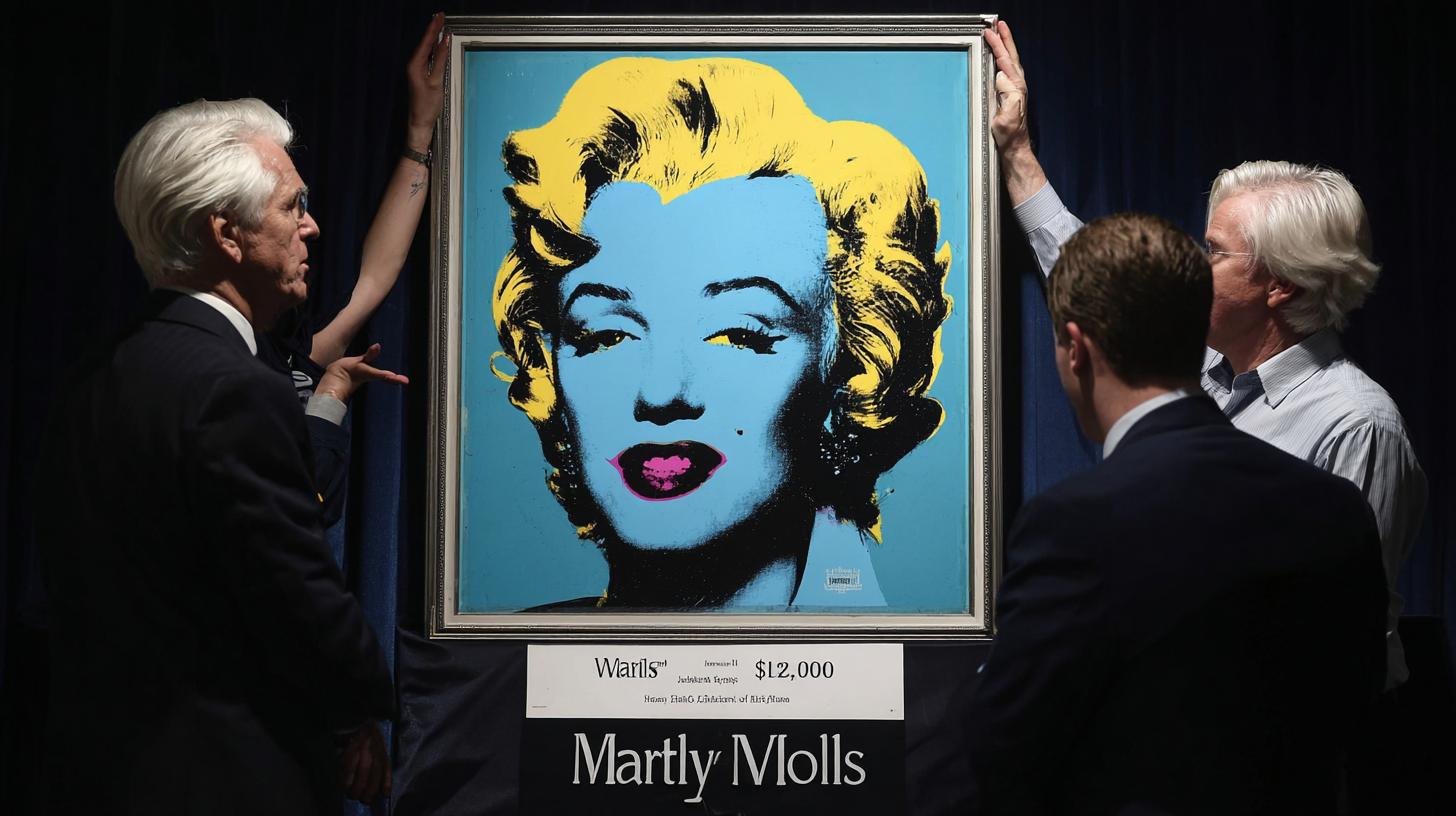

Christie’s hopes to sell Andy Warhol’s “Blue Marilyn” for $200 million, a bold target that has sent ripples through the art market and beyond. The announcement is part commerce, part theater: auction houses sell value and narrative at the same time, and a marquee estimate like this spins both into headlines. Whether the painting crosses that threshold depends on collectors, timing, and a few invisible levers behind the scenes.

- Why Blue Marilyn still stops people in their tracks

- How auction houses price a blockbuster painting

- Provenance and condition: the backbone of any high estimate

- Market precedent: the $195 million benchmark

- Christie’s sales strategy for mega-works

- Pre-sale theater: previews, catalogs, and narratives

- Why $200 million is plausible — and why it might fail

- Economic headwinds and the buyer pool

- The psychology of marquee lots

- Behind the scenes: guarantees, guarantors, and the auctioneer’s toolkit

- What a $200 million sale would mean for Warhol’s legacy

- Personal view from the preview room

- The future: private sale, museum acquisition, or auction drama

Why Blue Marilyn still stops people in their tracks

Andy Warhol’s Marilyn images are shorthand for 20th-century celebrity, mass media, and the paradox of public intimacy. The silkscreens capture Marilyn Monroe as both myth and commodity, flattened and amplified by the mechanical processes Warhol embraced to mirror the relentless repetition of popular culture.

Blue Marilyn, with its saturated hue and haunting gaze, reads like an icon made for the modern age. It’s not just a portrait; it’s a cultural fossil that keeps collecting value because successive generations keep projecting new meanings onto it.

How auction houses price a blockbuster painting

Valuing a work at the level of nine figures involves more than art-historical arguments; it combines market precedent, rarity, condition, and the mood among ultra-high-net-worth buyers. Auction houses also factor in publicity value—how a headline-grabbing estimate will draw bidders to the room or the phone.

Below is a brief list of the main variables that determine whether a painting becomes a $200 million sale.

- Provenance and exhibition history

- Condition, restoration, and technical authenticity

- Market comparables and recent auction records

- Economic climate and liquidity among collectors

- Sales strategy: guarantees, private sales, and third-party backing

Provenance and condition: the backbone of any high estimate

A clean, well-documented provenance can add tens of millions to an estimate. Collectors want certainty that a work has passed through reputable hands and institutions; museums lend credibility, and celebrity ownership can add cachet. A sketchy ownership trail or a disputed restoration can undercut excitement quickly.

Condition is equally crucial. At these price levels, conservators often spend weeks performing microscopic analysis to ensure that pigments, ground layers, and overpaints are original. Even a small varnish issue can become a negotiating point for buyers who are making a cultural and financial bet.

Market precedent: the $195 million benchmark

In May 2022, Christie’s sold Andy Warhol’s Shot Sage Blue Marilyn for $195 million, setting a record for 20th-century art and proving that bidders would pay astronomical sums for the right Warhol. That sale established a psychological floor for top-tier Marilyn works and gave auction houses a concrete benchmark for future estimates.

Setting the target at $200 million is less about a precise appraisal than about testing whether the market’s appetite has expanded since that record. The few-million difference is symbolic—an attempt to push the narrative from “record” to “new era.”

Christie’s sales strategy for mega-works

Auction houses use a toolkit of strategies when dangling a nine-figure lot in front of the market. Public previews, targeted marketing to international collectors, and private viewings for potential bidders all create a sense of exclusivity and urgency.

Guarantees and third-party underwriters often underpin these sales. A guarantee guarantees a minimum price, reducing the seller’s risk and arranging a floor that can be sold down to a guarantor if the lot fails to attract a winning bidder at auction.

Pre-sale theater: previews, catalogs, and narratives

Weeks of careful narrative-building precede an evening sale. Catalog essays position a work in Warhol’s canon, press releases emphasize rarity, and curators or scholars are sometimes enlisted to write context that appeals to museum-minded collectors. The aim is to make the lot feel indispensable.

Christie’s will likely stage a worldwide preview tour with evening receptions, private dinners, and high-touch outreach to VIP clients. Those moments create the face-to-face intimacy that convinces a buyer to commit tens of millions in someone else’s currency—trust and desire, packaged together.

Why $200 million is plausible — and why it might fail

The plausibility of a $200 million sale rests on Warhol’s cultural resonance and the presence of a single, motivated buyer. For trophy collectors, a Marilyn is not only a painting but an emblem. That emotional value can sway rational price limits under the right conditions.

Conversely, macroeconomic factors could derail the sale. Rising interest rates, tax uncertainties, and geopolitical instability tighten the pool of buyers willing to take on ultra-luxury assets. If several potential bidders step back, the hammer price can fall sharply below the headline estimate.

Economic headwinds and the buyer pool

Collectors of this scale are sensitive to liquidity and leverage. Private equity wealth, tech fortunes, and family offices supply much of the demand for prize paintings, and those sources can fluctuate with market cycles. Currency shifts and cross-border tax rules also influence who shows up in the room.

Additionally, museums and foundations have been more circumspect in recent years about blockbuster purchases, which narrows institutional competition. That leaves private collectors, whose motives range from investment to reputation building.

The psychology of marquee lots

Trophy art plays to ego as much as to investment: owning a marquee work confers instant cultural capital. Auction houses know this and manufacture the environment—drumrolls, curated audiences, and the performative auctioneer—that can produce emotionally-driven decisions.

Yet that same psychology creates volatility. If the story fails to take hold in the press or among collectors, the lot can look less essential, and bids dry up. Selling is as much about crafting a myth as it is about preparing the painting.

Behind the scenes: guarantees, guarantors, and the auctioneer’s toolkit

Guarantees are common on lots expected to reach records. The auction house or third parties promise a minimum return to the seller, sometimes in exchange for a fee or a share of upside. The arrangement can reduce a seller’s risk but also complicate the bidding narrative if guarantors decide to buy back the work.

The table below outlines typical mechanisms used to secure mega-sales and how they change the dynamics of bidding.

| Mechanism | What it does | Effect on sale |

|---|---|---|

| Seller guarantee | Minimum price assured to seller | Reduces seller risk; may limit upside if guaranteed by auction house |

| Third-party guarantee | External underwriter takes risk | Creates confidence; introduces another stakeholder |

| Buyer’s premium | Fee added to the hammer price paid by buyer | Affects final cost for buyer; can influence bidding strategy |

What a $200 million sale would mean for Warhol’s legacy

A sale at that level would cement Warhol’s status not just as a pop artist but as an enduring cultural commodity. It would be read in auction histories as another stage in the market’s elevation of 20th-century masters to the rarefied ranks once occupied only by older European names.

That kind of headline also shapes museum programming and private collecting. A staggering price draws new audiences and forces institutions to re-evaluate the place of pop art in canonical narratives, potentially funding acquisitions and exhibitions for years.

Personal view from the preview room

I once attended a preview where a Warhol was displayed under museum lights, and the room felt electric—like being near a famous athlete before a game. People whispered, photographers lingered, and you could feel value accreting around the object: a history made tactile.

Those in-person moments matter. They convert passive curiosity into decisive action, and for lots at the top of the market, human persuasion often trumps spreadsheets. A painting becomes more than pigment when you stand close enough to see the texture and the tiny imperfections that make it real.

The future: private sale, museum acquisition, or auction drama

If the public sale stumbles, a viable alternative is a quiet private sale or a negotiated agreement with a museum. Institutions sometimes acquire marquee works through anonymous donations or consortiums, spreading the financial burden while keeping the piece public.

Another path is fractional ownership or placement in long-term loans to museums that preserves public access while offering financial liquidity to owners. Each route changes the cultural calculus of the painting in different ways.

Whether Christie’s achieves the $200 million target will depend on choreography as much as valuation: the right buyer, the right mood, and the right story. If it happens, it will be a milestone in the market for postwar art; if not, the narrative will pivot quickly toward private deals and deferred headlines.

If you’re curious to follow developments and read more analysis on bold auction targets and art-market strategy, please visit https://themors.com/ and explore our other materials.