Europe’s startup landscape looks different coming out of the pandemic years — denser in some corners, more distributed in others, and quietly more ambitious across the board. In 2025 you’ll find familiar giants still pulling significant investment and talent, but also smaller cities carving niches with supportive policies, deep technical talent, and lower costs. This article maps the strongest ecosystems, the patterns that matter to founders and investors, and practical advice for choosing where to plant roots or scale next.

- What makes an ecosystem truly strong?

- Top startup ecosystems in Europe in 2025

- London

- Berlin

- Paris

- Stockholm

- Amsterdam

- Barcelona

- Lisbon

- Dublin

- Copenhagen

- Helsinki

- Munich

- Zurich

- Tallinn

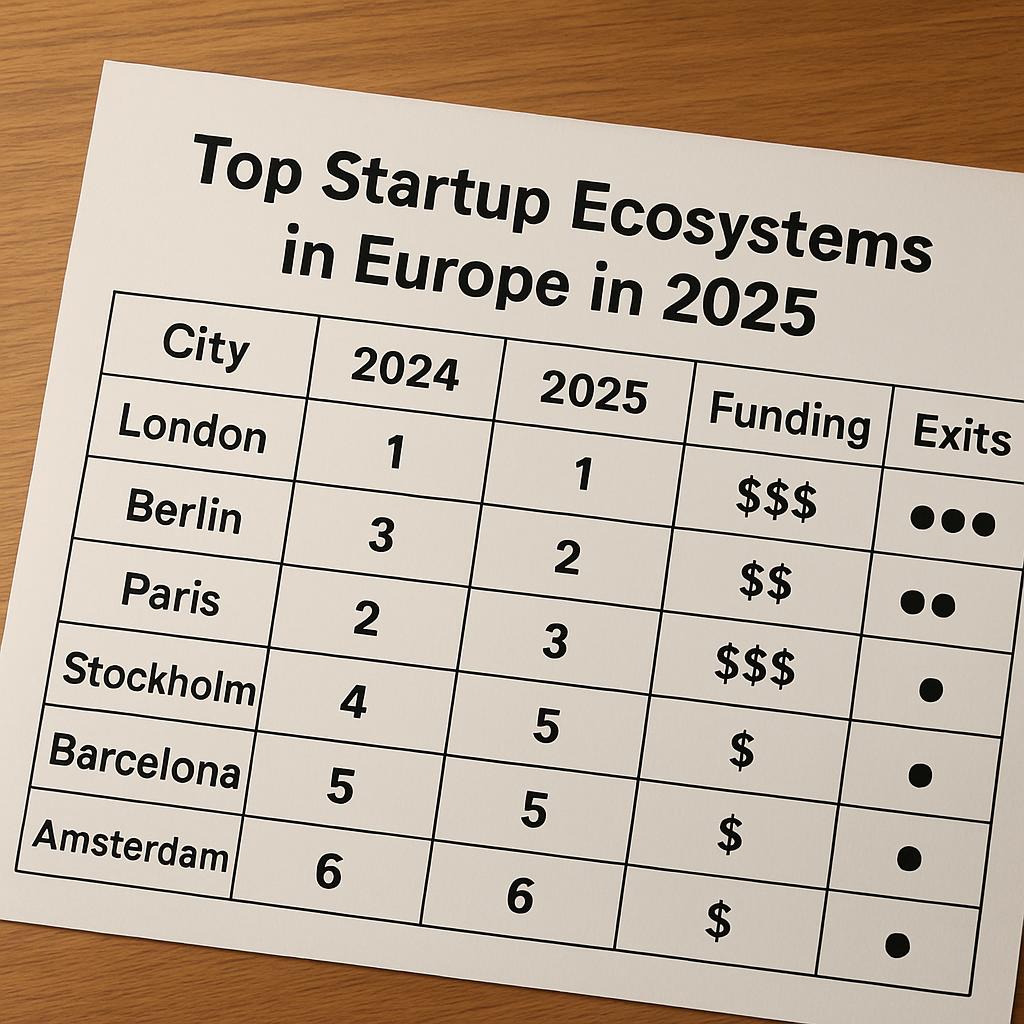

- Snapshot table: quick comparison

- How to choose the right European base for your startup

- Practical checklist for founders relocating or scaling in Europe

- Funding pathways and investor behavior

- Emerging trends shaping Europe’s startup landscape

- Real-life example: scaling from Lisbon to London

- When a smaller ecosystem beats a capital city

- Common pitfalls founders encounter in Europe

- Advice for investors evaluating European startups

- Predictions for 2026 and beyond

- Final thoughts and next steps

What makes an ecosystem truly strong?

At a glance you might measure an ecosystem by money: venture capital flowing, exits happening, and valuations rising. But deeper resilience depends on several intertwined elements — talent pipelines, accessible customers, research institutions, supportive regulation, and an operational fabric of mentors, service providers, and corporate partners.

Quality of life and cost matter in practice. Affordable housing, efficient transport, and cultural life help founders attract and keep talent. Conversely, sky-high rents and heavy bureaucracy can derail even well-funded startups in weeks.

Finally, networks are what turn raw inputs into momentum. When investors, founders, universities, and large companies talk to one another regularly, opportunities surface faster and failures become learning loops rather than dead ends.

Top startup ecosystems in Europe in 2025

Below I profile the ecosystems that stand out this year for funding, talent, specialized clusters, and momentum. Each city brings a different mix of advantages; pick the combination that matches your stage and sector. The list is not exhaustive but highlights places where founders repeatedly tell me they see the best odds for scaling.

Across these ecosystems you’ll notice recurring themes: stronger verticals (AI, climate tech, fintech, biotech), better access to late-stage capital, and more cooperation between local governments and private players. These factors bend the arc of success for startups in tangible ways.

London

London remains the continent’s financial and talent heavyweight. Its strength in fintech, enterprise SaaS, and deep AI research keeps it a magnet for both early-stage founders and global investors. Even after regulatory and political changes, the city’s density of experienced operators and international connections is hard to replicate elsewhere.

Founders benefit from a broad pool of serial entrepreneurs and advisors who understand scaling across markets. That experience often shortens fundraising cycles and helps startups access U.K. and global corporate customers quickly. If you need international reach and access to major financial institutions, London still often leads the pack.

Berlin

Berlin combines a creative culture with an engineering workforce and relatively lower costs than some Western peers. It’s a hotspot for consumer tech, marketplaces, and developer tools, with a lively festival and events calendar that keeps networks fluid and connected. Berlin’s coworking spaces and incubators still make it easy to meet co-founders and early hires.

I’ve spent time in Berlin’s small cafés and found that conversations there frequently turn into partnerships; that informal deal-making matters more than people expect. Local investors are comfortable with risk and scale, which keeps bold ideas alive and growing.

Paris

Paris has become a standout in deeptech, AI, and cleantech, buoyed by government programs and a string of high-profile successes. A strong university system and new research centers are feeding startups with PhD-level talent, while the national French Tech initiative provides meaningful support and visibility.

Beyond policy, Parisian founders benefit from access to European headquarters of many multinational companies. That provides validation paths and pilot opportunities for B2B startups. The city’s evolving startup culture feels less hierarchical and more collaborative than a decade ago.

Stockholm

Stockholm continues to punch above its weight with a high number of unicorns per capita. The city’s strength is in software, gaming, and fintech — areas where small teams can build global products quickly. Investors in Stockholm are particularly attuned to product-market fit and international expansion from day one.

Founders often credit a strong technical education system and a culture that nurtures long-term product thinking. If you value disciplined engineering and international scaling chops, Stockholm remains a smart choice.

Amsterdam

Amsterdam blends a business-friendly environment with exceptional connectivity to European markets. It’s a prime location for startups focused on logistics tech, adtech, and sustainability solutions. The presence of global enterprise headquarters and a pragmatic regulatory stance makes pilot programs easier to launch.

English is widely used in both business and everyday life, lowering friction for international teams. For companies prioritizing efficient European distribution and corporate partnerships, Amsterdam’s infrastructure and openness are clear advantages.

Barcelona

Barcelona is growing as a hub for health tech, design-led consumer startups, and remote-first teams. Its quality of life, climate, and lower operating costs attract founders who want a balanced lifestyle without sacrificing access to talent and capital. Recent years have seen a maturing investor community that supports more ambitious rounds.

Events such as major tech conferences bring visibility and deal flow, creating opportunities for early-stage companies to meet investors and corporates in concentrated windows. For founders who value talent retention and a creative labor market, Barcelona’s appeal keeps increasing.

Lisbon

Lisbon has transformed from a tourist mecca to a thriving startup magnet, boosted by relatively low costs, incubator programs, and visible success stories. The city’s growing cohort of accelerators and a welcoming immigration framework make it easier for international founders to relocate and test European product-market fit.

Portugal’s investment in digital infrastructure and supportive local policies helps early-stage teams stretch runway further than in Western capitals. For teams in the seed and pre-seed phase, Lisbon offers a practical mix of affordability and access.

Dublin

Dublin benefits from close ties to major U.S. tech firms and a strong English-speaking workforce, which simplifies hiring sales and engineering teams. The city’s legal structure and tax environment have historically attracted multinational corporations, creating ample corporate partnership opportunities for startups.

That corporate presence feeds a healthy market for enterprise pilots and talent with experience scaling globally. For B2B startups aiming to onboard Fortune 500 customers, Dublin often serves as a useful European foothold.

Copenhagen

Copenhagen is increasingly recognized for its strengths in sustainability, biotech, and foodtech. Denmark’s research institutions and a regulatory environment favorable to experimentation give startups a runway to test hardware and life sciences innovations. The city’s quality of life also helps retain highly skilled workers.

Local investors and public funds show an appetite for deep, long-term bets — important when your product requires extensive R&D or regulatory approval. The ecosystem’s collaborative ethos also smooths the path from research lab to commercial product.

Helsinki

Helsinki’s startup scene shines in gaming, health tech, and AI-driven services. The Finnish approach to education and public digital services generates talent that’s deeply comfortable with software and user-centric design. Seed-stage support networks, including accelerators and angel groups, are particularly active.

Founders often mention the practicality of the Helsinki investor community: they prefer clean metrics and clear roadmaps, which speeds up decision-making. That clarity helps startups iterate quickly and secure follow-on funding.

Munich

Munich is a heavyweight in deep engineering, automotive tech, and industrial software, supported by strong university-industry linkages and a cluster of manufacturers. Startups here often benefit from partnerships with large OEMs and a talent pool rich in systems engineering and hardware experience.

The culture favors methodical product development and long-term scaling. For founders building industrial-grade solutions or embedded systems, Munich combines technical competence with ample pilot customers.

Zurich

Zurich’s financial services prowess gives it an edge in fintech, crypto, and privacy-first technologies. A stable legal environment and high-quality research institutions add credibility for startups tackling regulated markets. Capital and client access in finance are practical advantages for scaling B2B offerings.

While operating costs are high, the ecosystem offsets that with superior talent and proximity to European and global financial players. Founders who need deep domain expertise in finance often find Zurich uniquely efficient.

Tallinn

Tallinn and Estonia more broadly have become emblematic of digital-first governance and e-residency, attracting founders who value nimble regulatory frameworks and fast company setup. The local tech community is small but technically strong, with a knack for building secure, scalable products.

Startups benefit from an infrastructure that treats digital services as a first-class part of governance, making public-private collaboration more seamless than in many other places. For companies focused on security, identity, or public sector tech, Tallinn has an outsized appeal.

Snapshot table: quick comparison

| City | Strengths | Ideal for |

|---|---|---|

| London | Finance, enterprise, talent depth | Fintech, SaaS, global expansion |

| Berlin | Creative culture, lower costs | Consumer tech, marketplaces |

| Paris | Deeptech, AI, public support | AI, cleantech, biotech |

| Stockholm | Product-driven engineering | Gaming, fintech, SaaS |

| Lisbon | Cost efficiency, warm climate | Early-stage startups |

How to choose the right European base for your startup

Selecting a headquarters should hinge on three core questions: where are your customers, where will you hire the talent you need, and how much runway can you realistically stretch? Answering those reduces a sprawling decision into practical trade-offs you can quantify.

Consider regulatory and tax regimes early, especially for fintech, health, and deeptech startups. Differences in data protection enforcement, product approvals, and employment law can change timelines and burn rates dramatically.

Finally, look beyond the city center. Satellite cities and secondary hubs often offer similar talent and network access at much lower cost. For many teams, a hybrid approach — sales presence in a major capital and engineering in a lower-cost city — is the most efficient path to scale.

Practical checklist for founders relocating or scaling in Europe

Moving or expanding into a new ecosystem is more than packing laptops; it’s a strategic project. Below is a concise checklist to keep teams from tripping on common issues.

- Legal entity setup and local tax implications — consult a specialist early.

- Employee contracts, benefits norms, and hiring timelines — align expectations with local norms.

- Banking and payments infrastructure — essential for payroll and customer transactions.

- Startup visa and immigration support for non-EU founders — start applications well in advance.

- Local investor and accelerator engagement — build relationships before you need a round.

Each item requires both a legal check and operational plan. That parallel approach ensures you don’t anchor critical decisions on assumptions that don’t hold in another country.

Funding pathways and investor behavior

European capital markets have matured: seed and Series A rounds are larger than five years ago, and later-stage capital is more available. However, investor preferences vary by city. Some ecosystems are still more tolerant of experimental product-market fits while others demand early proof points.

Local VCs and angel syndicates help with introductions to corporates and pilot customers, which can be worth as much as the money. Founders often underestimate the value of these introductions — they can compress product cycles and validate revenue models quickly.

Cross-border investors are increasingly active, but having a local lead investor still matters for follow-on rounds and navigating domestic customers. Prioritize building at least one deep local investor relationship in your primary market.

Emerging trends shaping Europe’s startup landscape

Several trends will define the next phase of ecosystem evolution: AI is reshaping product stacks across industries; climate tech is attracting more early-stage capital; and biotech and deeptech are gaining patient capital from public and private sources. These shifts create new hotspots and broaden the types of talent cities need.

Regulation is another driver. European initiatives around data protection, AI governance, and climate reporting are creating both constraints and market opportunities. Startups that design compliance into their core product often gain competitive advantage in B2B sales.

Finally, remote and hybrid work patterns have decentralized startup activity. Expect more cross-city founding teams, distributed engineering hubs, and partnerships that blend the strengths of multiple ecosystems rather than choosing just one.

Real-life example: scaling from Lisbon to London

I worked with a founder who started an environmental SaaS company in Lisbon because the team could build quickly on a modest budget. Early pilots in Portugal validated the model, but larger contracts required credibility in the U.K. and a presence near corporate buyers.

The team established a small commercial office in London while keeping development in Lisbon. That split model preserved runway and delivered the customer access they needed. Within 18 months they secured a multi-market partnership and a Series A that wouldn’t have been possible without the combined strengths of both ecosystems.

When a smaller ecosystem beats a capital city

Not every startup needs the lights and noise of a major capital. In specialized fields — synthetic biology, precision manufacturing, and hardware — proximity to university labs, manufacturing clusters, or specific suppliers outweighs general access to funding. Smaller ecosystems often win these bets because they concentrate domain expertise.

Founders who choose smaller cities intentionally often report faster hiring in niche roles and stronger local networks. If your product requires domain-specific engineers or access to specialized equipment, look for the cities where those assets are concentrated rather than the ones with the most headlines.

Common pitfalls founders encounter in Europe

One recurring mistake is underestimating the time it takes to localize product, sales approach, and legal compliance. Nearly every market in Europe has its own language, procurement habits, and expectations about contracts and warranties. Overlooking those differences slows adoption.

Another trap is hiring too quickly in a new location without clear integration plans. Cultural and operational alignment across offices require deliberate onboarding and communication cadence. Without that, teams fragment and product velocity drops.

Advice for investors evaluating European startups

Investors should assess not just the founding team and product, but the ecosystem fit. Does the startup have access to the customers it needs locally? Are there credible pilots and potential anchors within reachable distance? Those practicalities influence the pace of growth more than charm in a pitch deck.

Also, evaluate the team’s international playbook. Startups that can articulate a clear path from their home market to other European markets — or have a deliberate hybrid model — tend to scale more reliably than those that expect to “figure it out later.”

Predictions for 2026 and beyond

Expect continued diversification. Secondary cities will gain share as founders seek lower costs and better work-life balance. Capital will follow proven verticals like climate tech and AI, but new subclusters may form around national strengths in manufacturing or healthcare.

Regulation will play an increasingly visible role — not just as a headwind but as an axis for product differentiation. Startups that bake compliance and ethics into their offerings will capture enterprise customers faster than those that retrofit later.

Final thoughts and next steps

Choosing where to found or scale a startup in Europe in 2025 means weighing funding, talent, regulation, and quality of life. There is no single right answer; the best base depends on your sector, stage, and appetite for risk. Use the profiles above to identify a short list, then spend time locally meeting customers, investors, and peers before committing.

If you enjoyed this overview and want to dive deeper into specific markets, trends, or practical guides for relocating, visit our resource hub for continuous updates and in-depth analysis. Check out other materials on our website: https://themors.com/technology-innovation-news/ and explore more at https://themors.com/.